Tax computer depreciation calculator

All non-business taxpayers can claim a full deduction if the computer laptop or tablet costs no more than 300. Depreciation Calculators Tax Calculations.

Macrs Depreciation Calculator Straight Line Double Declining

First one can choose the.

. 264 hours 52 cents 13728. Now that you know how to calculate your business portion the real fun can begin. What if you rent your computer or laptop.

To work out the decline in value of his desktop computer Colin elects to calculate the decline in value of his computer using the diminishing value method. Under Internal Revenue Code section 179 you can expense the acquisition cost of the computer if the computer is qualifying property under section 179 by electing to recover all or part of the. D i C R i Where Di is the depreciation in year i C is the original purchase price or.

MACRS Depreciation Formula The MACRS Depreciation Calculator uses the following basic formula. The depreciation expense for 2019 shall be 1020. Depreciation is allowable as expense in Income Tax Act 1961 on basis of block of assets on Written Down Value WDV method.

This Excel worksheet will calculate standard depreciation using various methods each with its own benefits and drawbacks. Depreciation Calculator as per Companies Act 2013. Where the cost is more than 300 then the depreciation.

Depreciation on Straight Line Method SLM is not. Depreciation Calculator This depreciation calculator is for calculating the depreciation schedule of an asset. Divide the depreciation base by the laptops useful life to calculate depreciation.

The opening NBV for 2019 would be 7300 8500 1200. Normally computers are capitalized and depreciated. This tool is available to work out the depreciation of capital allowance and capital works for both individual and businesses taxpayers.

Compare different assets for example the SP 500. TaxAdda Private Limited CIN - U93000RJ2019PTC067547 GSTIN - 08AAHCT6764E1Z1. Non-ACRS Rules Introduces Basic Concepts of Depreciation.

The tool includes updates to. First one can choose the straight line method of. It provides a couple different methods of depreciation.

The calculation methods used include. Choose Property Type Construction Type Quality of Finish Estimated Year of Construction Estimated Floor Area Year of Purchase State then. Historical Investment Calculator update to 15 indices through Dec.

This limit is reduced by the amount by which the cost of. Basic Tax Depreciation Overview Including Depreciation Methods Accounting Procedures. How to use the Tax Depreciation Calculator.

For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. DEPRECIATION FORMULA ACV RCV - DPR RCV AGE EQUATION VARIABLES ACV Actual Cash Value Depreciated Value AGE Age of Item Years RCV Replacement Cash Value. Section 179 deduction dollar limits.

Hence the depreciation expense for 2018 was 8500-500 15 1200. Before you use this tool. Depreciated for the regular tax using the 200 declining balance method generally 3 5 7 or 10 year property under the modified accelerated cost recovery system MACRS.

Understanding computer depreciation.

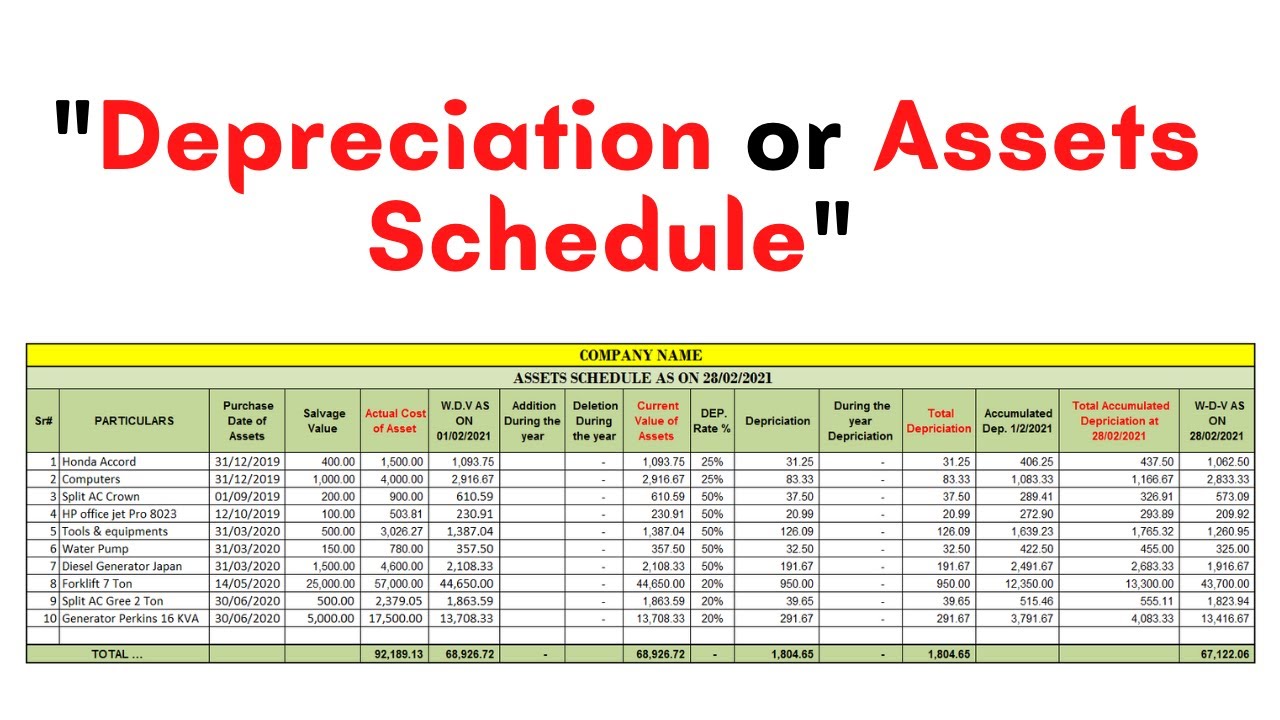

How To Prepare Depreciation Schedule In Excel Youtube

Free Macrs Depreciation Calculator For Excel

Depreciation Formula Calculate Depreciation Expense

Guide To The Macrs Depreciation Method Chamber Of Commerce

1 Free Straight Line Depreciation Calculator Embroker

How To Calculate Depreciation Expense

Depreciation Calculator Depreciation Of An Asset Car Property

Manufacturing Equipment Depreciation Calculation Depreciation Guru

How To Calculate Depreciation As Per Companies Act 2013 Depreciation Chart As Per Companies Act Youtube

Double Teaming In Excel

Depreciation Formula Calculate Depreciation Expense

Computer Software Depreciation Calculation Depreciation Guru

Depreciation Formula Examples With Excel Template

Declining Balance Method Of Depreciation Formula Depreciation Guru

Computer Software Depreciation Calculation Depreciation Guru

Depreciation Rate Formula Examples How To Calculate

Different Methods Of Depreciation Calculation Sap Blogs